Congratulations you finally decided to start journey of personal finance management.

However, please make sure to polish following attributes so as to become efficient finance manager.

- Be consistent – it’s an attitude which takes time to develop.

- Have faith – Nothing is unachievable if you decide to achieve.

- Have financial discipline – You need to bind yourself with certain boundaries.

- Keep eyes to achieve financial freedom – It’s a driving force that will motivate you to implement financial discipline in your life.

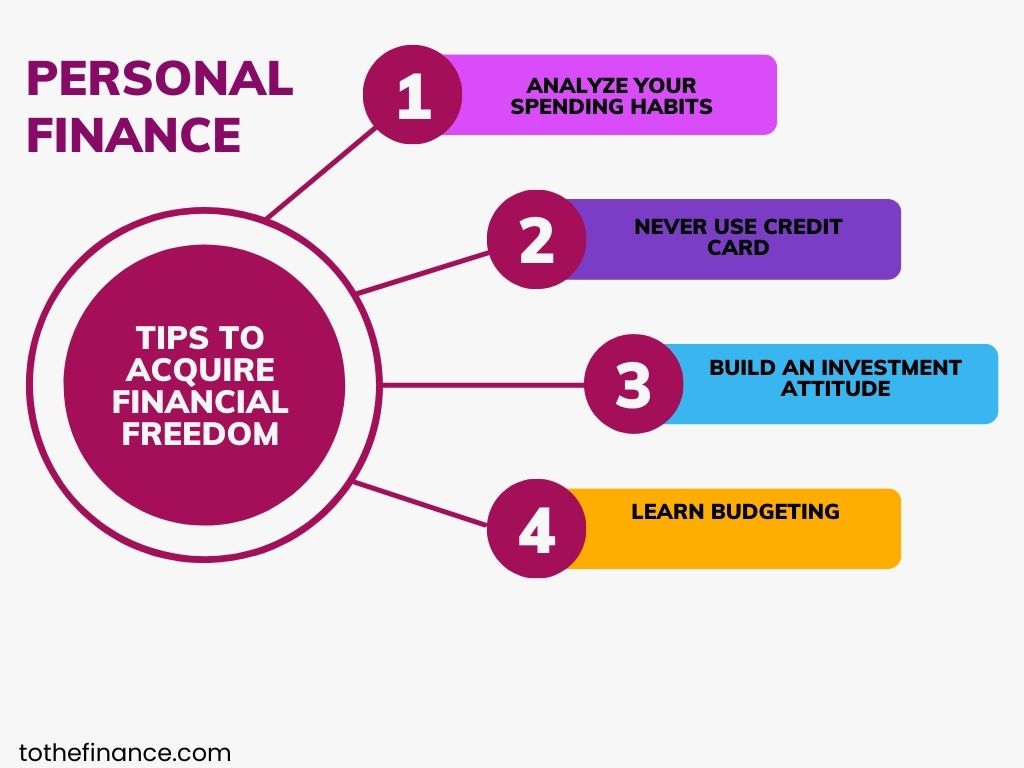

Let’s understand how exactly you can put yourself on the road to success and achieve financial freedom.

1-Analyze your spending habits

Record all of your expense on daily basis and allocate to certain categories. For instance, categories can be foods and groceries, clothing, traveling, health, and entertainment expenses etc.

Once you have sufficient data at the end of week/month, start analyzing if you have been doing good or there is significant expense in areas of entertainment and other discretionary expenses.

Please note you can also use any mobile app/software to record daily expenses.

2-Promise yourself not to use credit card again

Try to avoid using credit cards because of following facts.

- It’s a great source of impulse buying.

- You think it’s a financial favor but it’s a trap in reality.

- Interest rate is significantly higher than other financing sources.

- It’s a way to drain your salary even before you receive it.

- It’s designed to ensure you never focus on savings and investment.

So, an excellent idea will be to give up the card or keep it only for extreme emergency.

3-Build an investing attitude

Never think that you will start investing once you reach certain threshold. For instance, most of the people think they will start investing once they reach $10,000 in savings. Please don’t make this mistake, remember, investing is not about big money but an attitude that needs to be developed with time. If you don’t invest small amounts, you won’t invest big amount because you never developed habit to invest.

So, even if you have $500 in savings, invest it, invest it, and invest it.

4-Learn budgeting

Budgeting is the first step towards financial independence and financial security. Let’s think like this,

- No big companies and countries can run their operations without budget.

- If you don’t make and implement budget it’s difficult to remain financially discipline.

- Without budget, you always remain confused where funds are going.

Conclusion

In given article, we’ve discussed four steps to start journey of personal finance management. These steps include following.

- Making a budget and achieving financial discipline.

- Analyzing spending structure.

- Building investing attitude.

- Never use credit card – these are revenue making products for banks at your expense.