The Nominal ledger is also referred as a general ledger. All transactions of the company are recorded in the chart of accounts. These chart of accounts are sub-ledgers that combine to produce a comprehensive set of transactions called a nominal/general ledger.

The balance in the general ledger is referenced and sorted to ensure accurate reports are produced for financial statement preparation and other uses.

The items in the nominal ledger are sorted as assets, liabilities, equity, expenses, and income to produce a set of financial statement. The financial statement includes a balance sheet, profit and loss, changes in equity statement, comprehensive income, and notes to the account.

At the time of closing accounts, the ending balance from each ledger is extracted to produce a trial balance to be used in the preparation of a financial statement. The general ledger is used for multiple accounting purposes like to:

- develop cost centers and departments

- make journal entries

- prepare budgets

- produce financial statements

- record accruals and prepayments

A nominal ledger is also utilized to accomplish sophisticated accounting activities in conjunction with other operations. Further, it’s crucial to maintain track of your company’s details via bookkeeping. A thorough understanding of the accounting processes can help to maintain track of financial information.

The Example of the Nominal ledger

Suppose we got $5,000 financing in cash from Max on January 1st, the year in question. It will appear like this in the journal entry: (We assume that the journal serial number is xx for this particular voucher):

| Description | Debit | Credit |

| Cash | 5,000 | |

| Max payable | 5,000 |

The debit impact of the transaction is the receipt of the cash. This is the amount receipt against the finance raise. On the contrary, the credit impact of the transaction is recorded for the liability. It’s due to the fact that financing has been raised via debt.

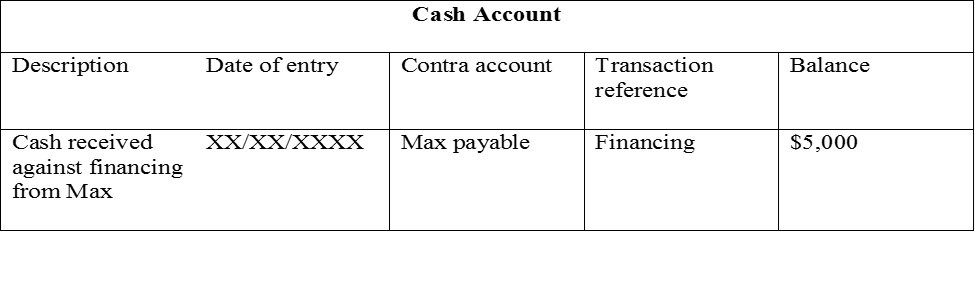

Given journal entry transactions can be entered in the general ledger as below. It’s important to note that the above journal entry is posted in two nominal ledgers. These nominal ledgers include a cash account and Max payable account.

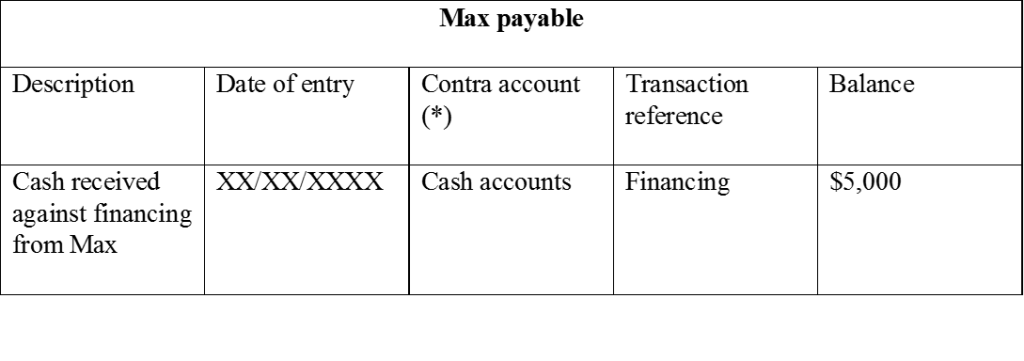

The other side of the journal entry is posted in the Max account as follows.

Contra Account (*): The contra account helps enhance our understanding of the transaction. For instance, by looking at the Max payable ledger’s contra account, we can state that $5,000 was received as cash.

Cash nominal ledger bank reconciliation

The cash nominal ledger’s most important role is to execute bank reconciliations. Checking your bank transactions against your accounting records is what we mean when we say “do a reconciliation.”

Because the balances on the nominal ledger need to be checked for accuracy, it compares the cash balance on the company’s balance sheet to the comparable amount on the bank statements. In order to guarantee that everything is in order and that no frauds or monetary manipulations have occurred, this is carried out

Nominal vs. General ledger

“Nominal Ledger” and “General Ledger” are sometimes used interchangeably when discussing how to handle corporate finances. Because the two words are interchangeable, there is no room for misunderstanding. If you’re confused about the distinction between a nominal ledger and a general ledger, simply remember that the only thing that sets them apart is their names.

Traditional vs. Digital Nominal Ledger

It takes a lot of time to manually enter each accounting entry in a paper ledger. Traditionally, accounting records of a company were kept in this system. Still, there are certain firms that retain a paper logbook. In order to keep the books in balance, data were recorded on both the credit and debit sides here.

In modern times, you no longer have to spend a lot of time entering data and doing calculations to keep your books in order, thanks to advancements in computer technology. The use of a paper ledger has been rendered obsolete by simple computer tools like Excel and different types of accounting software.

The old nominal ledger has been mostly replaced by a variety of accounting programmers. Apps like Quickbooks, Waves and Xero enable you to do a wide range of accounting and bookkeeping functions, such as bank reconciliation and time tracking on a convenient device. As a consequence, accounting procedures are now simpler, faster, and more cost-effective.

Nominal vs. Private Ledger

Expenses, income, depreciation, insurance, and other information may be found in the nominal ledger. There are two types of nominal ledgers: the public ledger and the private ledger. The private ledger is only available to a selected group of people.

A private ledger is essentially a book of accounts in which secret accounts are kept. As a result, every account that poses a privacy risk or is critical to the business’s owners is included under the heading “Private ledger.”

Private ledgers may have existed before the current incarnation of accounting took shape, but they have emerged as an important feature with the integration of information technology into accounting systems. Because the accounting department’s bookkeeping, posting, and approval duties are separated across many teams, owners may choose to have a small number of ledgers made private so that only they have restricted access.

Quick Sum Up

So, we’ve given you an introduction to the nominal ledger and why you need it, along with some examples of its past and present uses. You may find a variety of samples and templates for a nominal ledger on the internet. However, if you don’t have a financial background and your firm is developing, it’s not a viable option to handle your company’s finances on your own. You need to be careful in this situation since even a little error might cost you a lot of money. Because of this, hiring an accountant is a worthwhile investment of time and cash.